DSM Instructional – Writing off /

adjusting invoices

These instructions cover writing off / adjusting an invoice.

There are times when an invoice is partially paid and you

wish to write off the remaining balance.

Below is how to accomplish this.

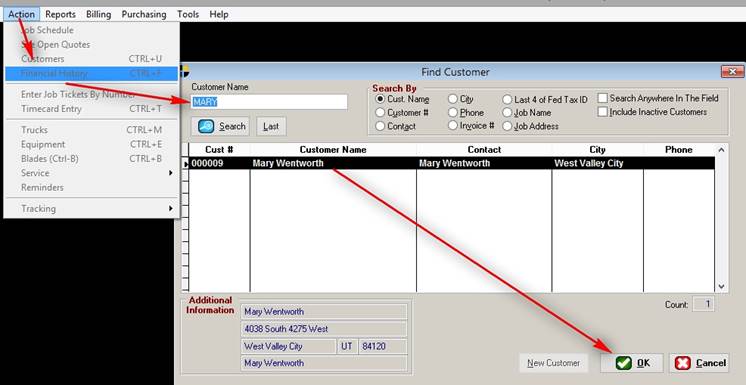

First, go to action > see financial history as seen

below.

Select the customer in question, then hit OK, or double

click on them. It will bring up the

financial history screen as shown below.

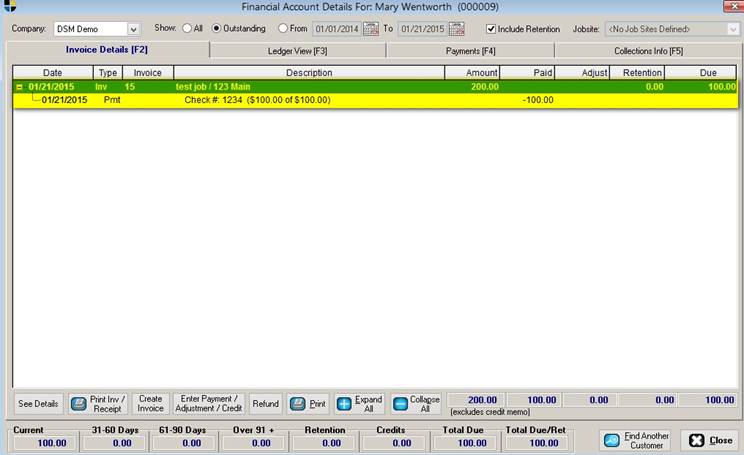

Find the invoice in question and highlight it. Notice that for this example, the invoice was

200 dollars and has 100 dollars already applied to it due to a check.

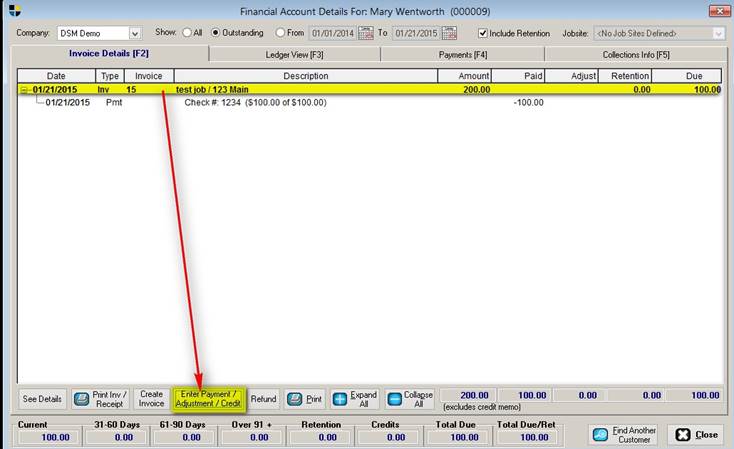

For this example, we’ll adjust it as if we were going to write it off. So, highlight the invoice in question and

click the Enter payment / Adjustment / Credit button.

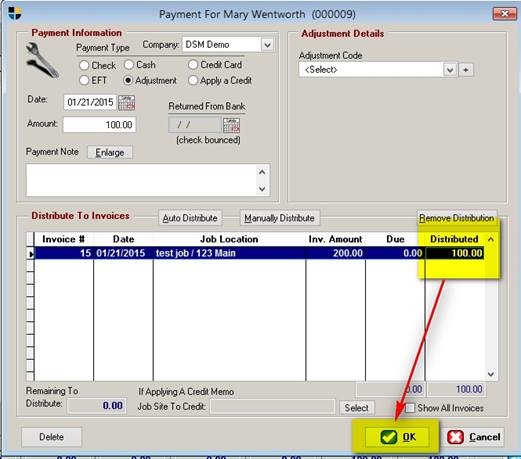

You will then see the following screen:

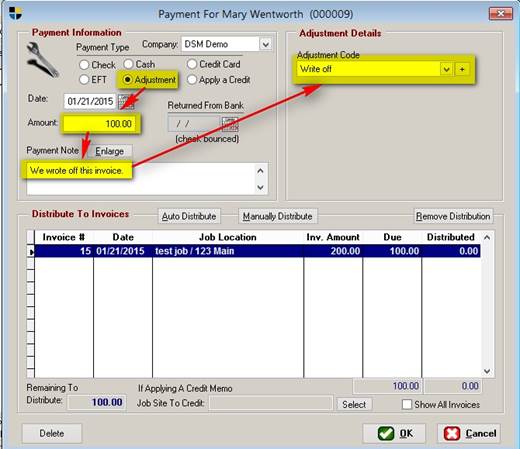

First, put the dot next to “Adjustment” and enter your date

and the amount. If you like you can also

put a note reflecting a reason. After

that, pick your adjustment code. If you do

not have one, you may add it at any time by clicking the plus button next to

the adjustment code drop down box.

Next, double click the invoice in question. You will see the following screen:

By default, the amount of the adjustment you’d typed earlier

will be in the amount to distribute box.

If this is the amount you wish to distribute, just click ok.

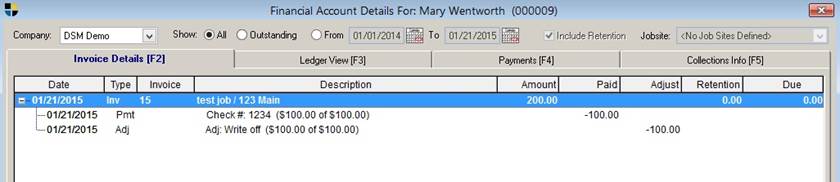

The screen will then return to the prior screen showing the

distribution. Just click ok here.

You will then be returned to the main financial history

screen for the customer. By default you

will not see the invoice anymore because in this example, we paid it off. Click “Show All” above and you will see the

results:

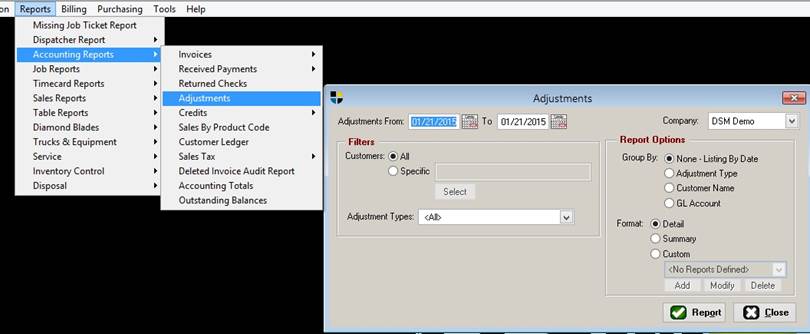

Finally, you may run a report showing this as well. Go to Reports > Accounting reports >

Adjustments.

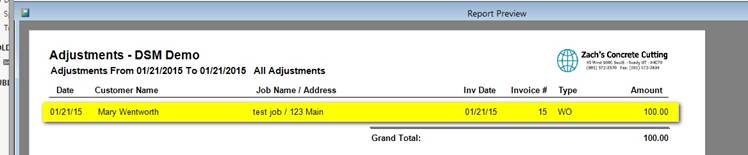

Choose your date range and click “Report.” For the example we used, you would see the

following report.

END OF DOCUMENT