QuickBooks Invoice Transfer

DSM can transfer invoices to QuickBooks to

avoid double entry. Using the QuickBooks

API, the invoices are validated and appear in QuickBooks just as you entered

them natively. To successfully send

invoices, DSM must reconcile the customers, Job Sites (optional), Payment

Terms, Sales Tax Codes, Invoice Codes and Salesman (optional) send the invoice

information.

Additional Resources:

QuickBooks Setup and

Configuration

QuickBooks

Initial Data Load

QuickBooks Accounts Receivable Sync

This document will cover:

ü Validating

Data in DSM

o Customer

Resolution

o Job

Resolution

o Resolve

Payment Terms

o Resolve

Sales Tax Code

o Resolve

Invoice Item Code

ü Transferring

DSM Invoices to Quickbooks

o Un-mapping

A Resolved Customer or Invoice Item

o Fixing

an Incorrect Invoice That Has Been Transmitted To QuickBooks

o Resending

an Invoice

o Excluding

an Invoice From Transferring To QuickBooks

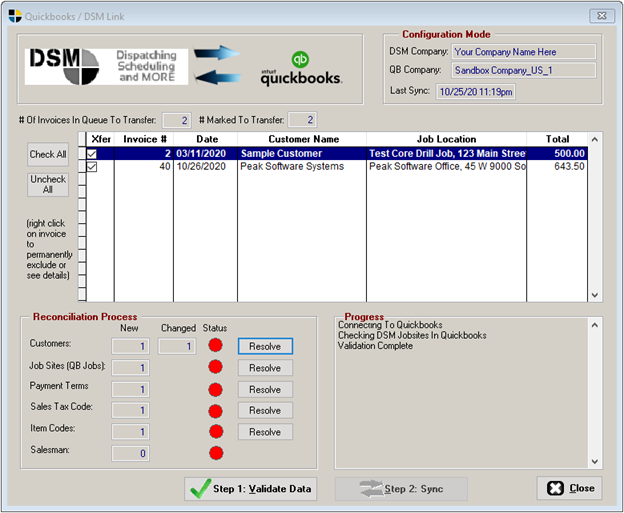

Validating

Data in DSM

To speed up the process, only the data which

is queued to transfer is checked. This

means for example the process may have run great yesterday but today we need to

reconcile a new customer or new item code.

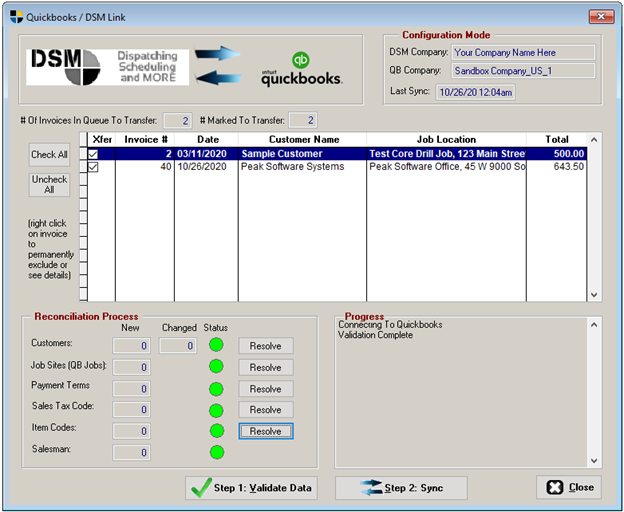

The 1st step is to validate the

data and resolve any missing mappings. Any

items with a red circle indicate there is data that DSM needs guidance on how

it should be represented in QuickBooks. The 2nd step is to actually

send the invoice data to QuickBooks.

To Transfer Invoices created in DSM to QuickBooks,

select Billing>QuickBooks

>QuickBooks Invoice Transfer.

See the sections below for details on

resolving any of these categories

Tip: You can uncheck any

invoices you don’t wish to send to QuickBooks at this time. This is useful if one has resolutions issues

you need to research but others are ready to go.

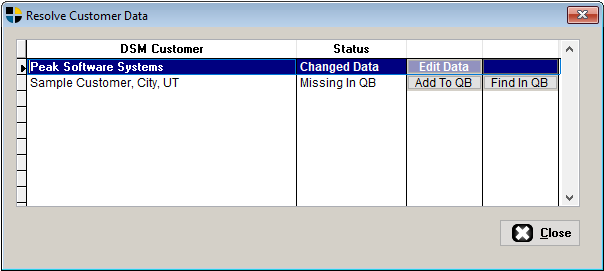

Customer Resolution

Two problems can occur for customer

resolution.

1. DSM doesn’t know who the customer is.

Resolution: Map this customer to

an existing QuickBooks Customer or have DSM add the Customer to QuickBooks

2. DSM detects that critical address

information is out of sync.

Resolution: Tell DSM which data is

correct. It will then either fix DSM’s

information or QuickBooks.

Press the [Resolve] button.

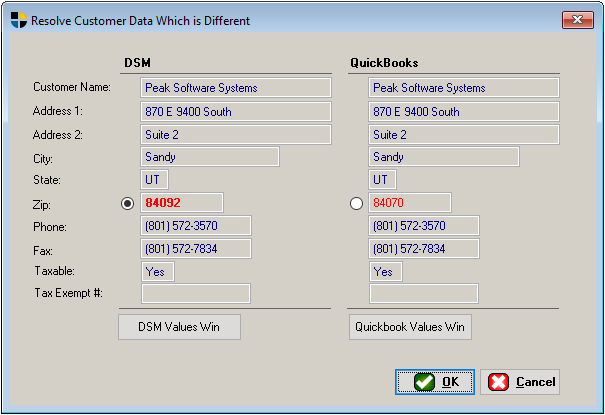

In this case Peak Software Systems has

critical Customer Information that could affect an invoice and is not in

sync. We simply check the radio box for DSM Wins or QuickBooks Wins and the loser’s data is updated with the

correct information. You can mix and

match in the same transaction if some data is correct from each.

Click [OK]

and the data should update and disappear off the Resolve Customer Data list.

Tip: If

it does not, as a last resort you can manually update QuickBooks or DSM. We have seen some issues in QuickBooks Online

where the tax status won’t update properly in some cases.

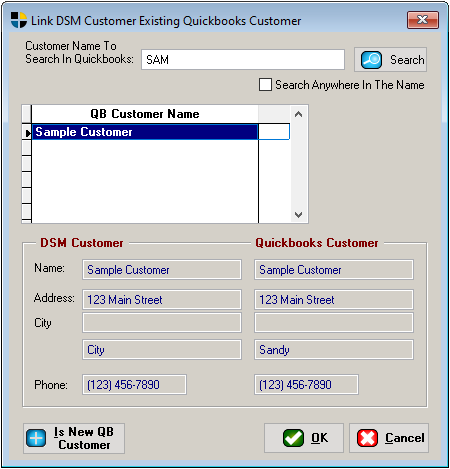

In the 2nd case with Sample

Customer, we highly recommend you select the find option to make sure you’re

not going to add a duplicate.

In QuickBooks Desktop (not shown), the

customer list shows all customers in the list and there is no search option. You simply page up and down. You can also type and it will do an

incremental search within the grid.

In QuickBooks Online (shown), you can try

different searches. By default, it

searches by the first 3 characters of the customer name.

If you can’t find the customer or are sure

it’s new, click the [Is New QB Customer[ button or the [Add to QB]

button on the prior screen.

This will automatically add the customer to QuickBooks.

Work through the list until all

customers are resolved.

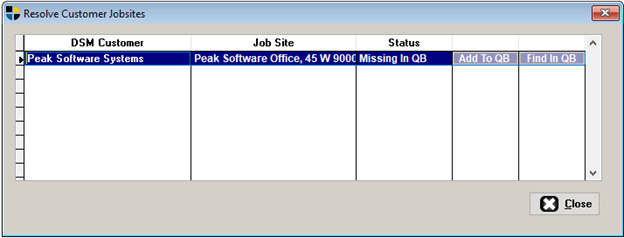

Job Site Resolution

As an optional feature, you can designate that

DSM Jobsites are QuickBooks jobs (set in DSM Company Configuration). When you do this, QuickBooks shows the

customer with a sub customer which represents the job. Only customers with jobsites will be linked

and you can mix and match (some have jobsites and some are simple one day jobs)

If you

are not doing this in QuickBooks now, we suggest you explore this feature

slowly and make sure you like how it works in QuickBooks. When the feature is disabled in DSM, it will

never cause a reconciliation issue.

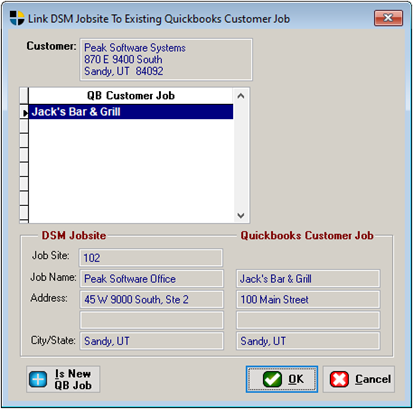

Click the [Resolve] button.

With jobsites, the address information is not

compared. So there are only two

resolution options.

1. Add the Jobsite to QB

2. Find the existing Jobsite In QB

If QuickBooks has the jobsite, then select it

and press [OK]. If you can’t find the jobsite or are sure

it’s new, click the [Is New QB Job] button or the [Add to QB] button

on the prior screen. This will

automatically add the jobsite to QuickBooks.

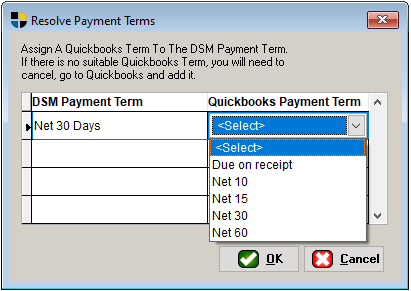

Resolve

Payment Terms

Payment Terms are simply the terms that print

at the top of the invoice and which determine when the invoice is overdue.

Click on the [Resolve]

button.

Due to the simple nature of Payment Terms,

your only option is to select an existing option in QuickBooks that represents

your DSM Terms. If none are

satisfactory, go to QuickBooks and add the Payment term there. Then repeat the reconciliation process and the

new term will appear for you to select.

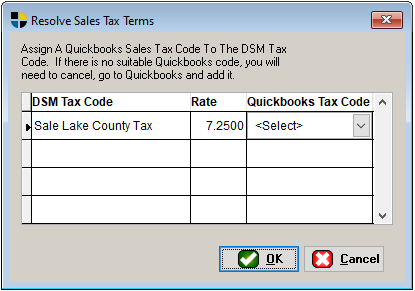

Resolve

Sales Tax Code

Sales tax codes determine the tax rate you

apply to your invoices. If using the QuickBooks

Online version in the United State, it ignores any codes you define and uses its

own tax engine. If you are using the

Desktop or QuickBooks Online in any other country, you will need to select the

appropriate codes.

If the tax code you need is not already

defined in QuickBooks, you will need to go to the QuickBooks software and add

it manually. Then repeat the

reconciliation process and the new tax code will appear for you to select.

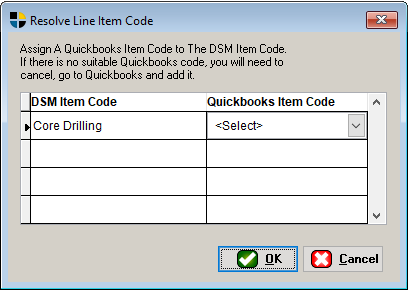

Resolve

Invoice Item Code

Item codes are the codes you select in the

billing process to categorize the work done.

Prese the [Resolve]

button.

If the item code you need is not already

defined in QuickBooks, you will need to go to the QuickBooks software and add

it manually. Then repeat the

reconciliation process and the new item code will appear for you to select.

Transferring

DSM Invoices to Quickbooks

When all your items are reconciled, you should

have a screen similar to this.

Press the [Step

2: Sync] button to actually send the invoice to QuickBooks and have QuickBooks

create these invoices.

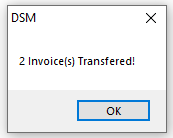

DSM should respond with a message indicating

that the invoices were transferred or an error message with information why it

did not transfer. An example which could

cause failure is if a DSM invoice # already exists in QuickBooks. In the desktop version, it will allow

duplicate invoice numbers, in QuickBooks Online it will not.

Finally go to QuickBooks and see the new

invoices. Note that the Desktop will

update automatically but QuickBooks Online may require you refresh your browser

to see the new data.

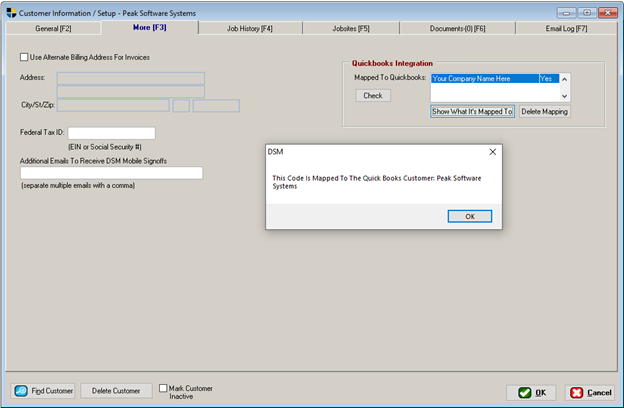

Un-mapping

A Resolved Customer or Invoice Item

There are times when you accidentally map a

DSM customer to the wrong QuickBooks customer or DSM Item Code to the wrong QuickBooks

Item Code.

In the case of customer, simply find the

Customer in DSM and go to the ‘More [F3]’

tab.

Check – This button sees if this customer is mapped

to DSM Company. In a multi company

configuration, we may see multiple companies mapped to this same DSM Customer.

Show What It’s Mapped To – This option actually queries QuickBooks

and shows you the information the customer name of the mapping. It should be the correct customer name. If not, simply click the [Delete Mapping] button.

Delete Mapping – This button will delete the highlighted

Quickbooks Mapping. Upon transferring an

invoice for this customer, you will be prompted to resolve the mapping to an

existing Quickbooks customer or add a new one.

You cannot click on this button without first clicking on the Check button.

In the case of the Item Code, simply Edit the

Item Code In DSM for similar options.

Fixing an

Incorrect Invoice That Has Been Transmitted To QuickBooks

Once you send an invoice to QuickBooks, DSM

cannot modify that invoice or delete it.

However, if an invoice is wrong, follow this procedure to remove it.

1. Delete the invoice in QuickBooks.

2. Delete the invoice in DSM.

3. Edit the job tickets and fix the

invoice.

4. Reinvoice the job in DSM.

5. Transfer the New Invoice To QuickBooks

using the standard ‘Transfer Invoices to QuickBooks’

screen.

If you don’t need to delete the invoice in DSM

to fix it but are simply editing something like a PO number, the easiest option

is to edit it in both places. However,

it is important for the sake of the QuickBooks AR Sync that the invoice totals

remain the same.

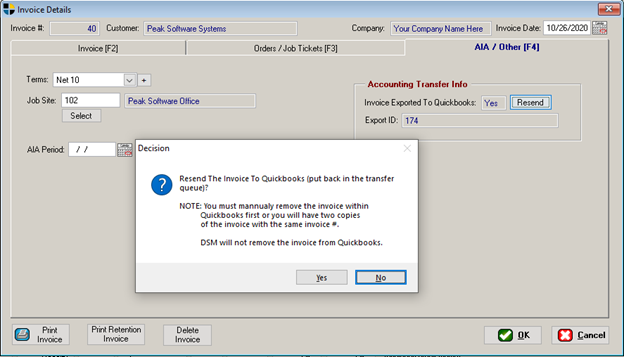

Resending

an Invoice

If for testing purposes you wish to try

resending an invoice without deleting it.

Follow this procedure.

1. Delete the Invoice in QuickBooks.

2. Edit the Invoice in DSM and select the

‘AIA / Other [F4]’ tab.

Select the [Resend] option.

3. Transfer the new Invoice to QuickBooks

using the standard Transfer

Invoices to Quickbooks screen.

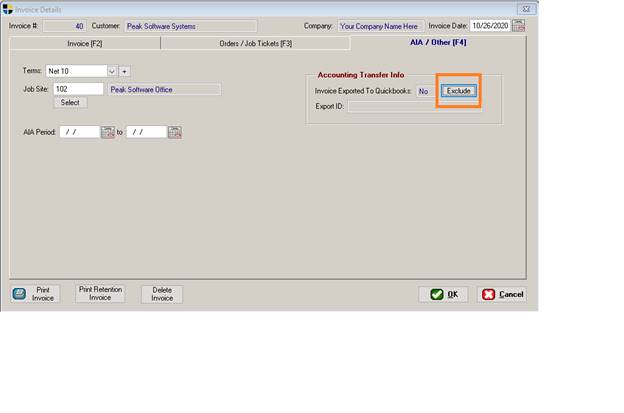

Excluding

an Invoice From Transferring To QuickBooks

If you have a case where you have an invoice

in DSM and you do not want to transfer it to QuickBooks, follow this procedure.

1. Edit the Invoice in DSM and select the ‘AIA / Other [F4]’ tab.

2. Select the [Exclude] button.

Note that if the invoice has already been

sent, the [Exclude] button

will be named [Resend].

DSM:QB:I:OCT20