Job Ticket Cost & Pricing

Analysis

The Job Ticket Cost & Pricing

Analysis report provides billing staff with analysis of job cost before it’s

billed. You can use it to help price a

job and actually compare 3 pricing models, the one given, one based on hourly

work type targets and one base on cost margins.

This is important as even bid jobs often suffer from scope creep and it

may be possible to identify and bill additional amount for work actually

performed.

The report utilizes the same job

costing methods as the Profit & Loss reporting for a consistent analysis

throughout DSM. It pulls costs such as

labor, blade usage, equipment usage, truck usage, mileage, overhead and job

expenses. Even if it does not make sense

for your company to track all these items, you will likely find this report

incredibly valuable.

This document will cover:

ü Accessing the Report

ü Job Ticket Cost Screen

ü Understanding the Report

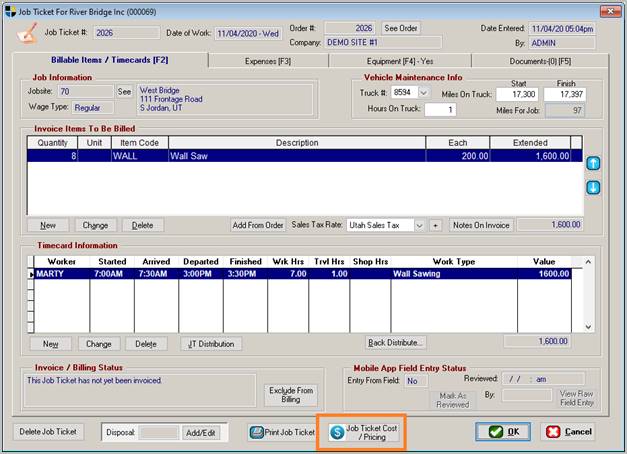

Accessing the Report

While this report is relevant to any

job, it is particularly useful in multi day jobs as it pulls and organizes all

those expense into one report.

Access this report right from the ‘Job Ticket’ screen.

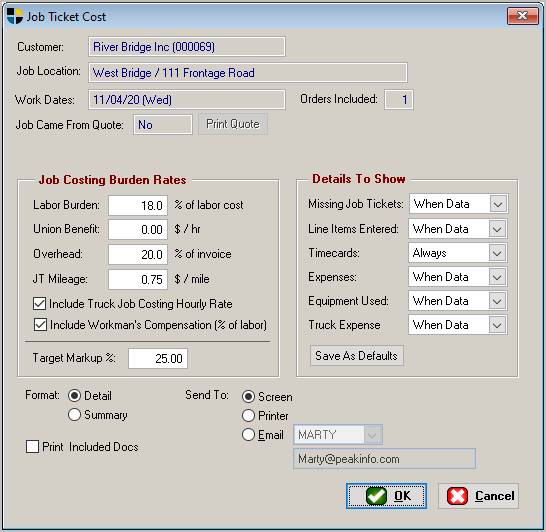

Job Ticket Cost Screen

The report takes a number of

parameters as shown below. Note that

different markets and different operation styles dictate what factors are

important. Everyone cares about labor

costs and overhead but many may choose that mileage is not worth tracking and

those costs are best absorbed in overhead.

Job Costing Burden

Rates (defaults set in File> Administration> Company

Configuration on the ‘Job

Costing’ tab)

Labor Burden %

- Percentage increase for direct costs related to labor such as Employer Taxes,

Benefits, Workman’s Compensation (if not tracked separately), etc. Any employee related expense that increase

with the hours works belongs in this category.

Union Benefit %

- Percentage increase for union related fees

Overhead %

– This is the percentage of the invoiced amount which is used to pay for

expenses not directly charged to the job.

The easiest way to calculate it is through last year’s financial

statement. You simply add all expenses

not charged to the job / total sales.

JT Mileage

– Mileage Rate charged if truck mileage is tracked on the Job Ticket.

Include Truck Job Costing

Hourly Rate – Some customers work with an hourly

cost to run a specific truck. Using this

setting you take the truck hourly rate set on the truck definition and multiply

it by the hours worked on the job.

Include Workman’s

Compensation (% of labor) – Some markets

have significant differences in the rates negotiated for various work

types. In this case you can specify the

workman’s compensation code by work type (editable on the Timecard portion of

the Job Ticket) and charge the job accordingly.

Most companies have the same rate for all jobs in which case it’s best

to leave this unchecked and include the rate in your labor burden figure.

Job Ticket Markup

– This is the margin % you would like to achieve over your total costs. Example: If you want a 25% markup and your

expenses were $1000 your target markup would suggest $1250 meaning you would

make $250 on expenses of $1000 or 25%

Details To Show

These options simply allow you to

shorten the report for information not important to you.

Format

Summary - format

simply suppresses all the detail

Print Included Docs

– This will print out all the included field tickets stored as documents with

the report. This Is analogous to a

salesman’s packet for pricing with all the job details.

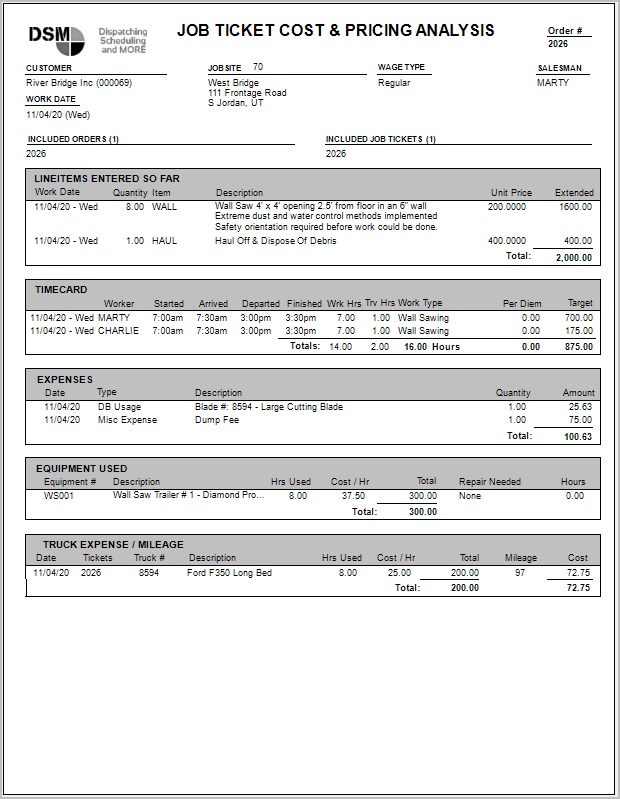

Understanding the Report

Line Items Entered So

Far

This shows what we’ve entered in for

billing so far. In some cases when doing

unit pricing, it will show the work done each day such as road work cutting

footage. This is useful information but

not used in the pricing analysis.

Timecard

This lists all the labor hours worked

on. It is important that the correct

hourly rates are setup on the user definitions for both work and travel

time. If the job is configured to use

certified payroll, those rates will apply to the total labor cost which is

shown in the summary. Note that the

rates come from the timecard which could be overridden for special rates,

overtime, double time, etc.

Expenses

Expenses include anything charged

directly to this job. This can be blade

footage which can easily be collected from the DSM Mobile app or hard expenses

such as tolls or dump fees. They are

entered in the Expense tab of the

Job Ticket.

Note: Expenses charged to the Jobsite

will not be included here as this report would not know how to break down the %

of that expense applicable to this invoice.

In that case use the Job Site Profit

& Loss Report.

Equipment Used

Equipment used is entered on the Equipment tab of the Job Ticket and

reflects the hourly cost of the equipment used.

This is useful for heavy equipment demolition type jobs where you want

to charge an hourly cost for a bobcat or demolition robot. DSM Mobile can aid in collection of this data

if you attach the equipment to the job.

Truck Expense

Mileage is the most common truck

expense if you are tracking mileage on the job ticket. Some companies also attach an hourly truck

rate to the job where the rate is defined with the truck and multiplied times

the total hours used (on job + travel).

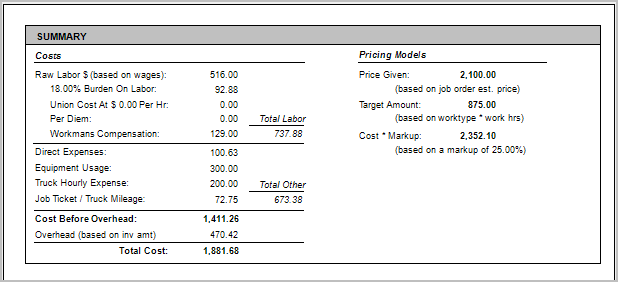

Costs

Raw Labor $ (based on

wages):

Simply the gross amount, hours * rate for the work done on the job. The rate includes any overtime, special rates

or certified payroll.

Burdon on Labor: Raw

Labor * Labor Burden %. This represents direct costs related to labor

such as Employer Taxes, Benefits, Workman’s Compensation (if not tracked separately),

etc. Any employee related expense that

increase with the hours works belongs in this category.

Union Cost: Raw Labor * Union Benefit %. This represents union related fees.

Per Diem: These are the costs paid to the employees

recorded on the timecard as per diem.

These usually include stipends for out of town lodging or meals.

Workman’s Compensation: This is the gross revenue * recorded

workman’s compensation rate. These are

selected on the timecard screen and usually correspond to the particular work

type. If all work types use the same

workman’s compensation rate, it is usually best to simply include the

percentage in the Burdon on Labor figure.

Direct Expenses: Expenses from the above detail

Equipment Usage: Equipment Usage from above

Truck Hourly Expense: Truck Expense from above detail

Cost Before Overhead: All the items above totaled

Overhead (based on inv amt): This is the invoice amount * Overhead %. On this report it uses the Invoice Amount of

the Cost * Markup amount. This is tricky

to calculate because as you increase the invoice amount to charge, your

overhead goes up. Fortunately, DSM

calculates this for you. In the example

above. In the example above, DSM

suggests we invoice $2,352.10 with a total cost of $1881.68. This means a profit of $470.42. If we take the profit / cost $470.42 /

1881.68 = .25 or 25% margin

Total Cost: All these expenses totaled

Pricing Models

Price Given: This is the quoted price listed on the Job

Order

Target Amount: This is the total hours worked times a

target rate defined for the work type of the Job. These rates are defined in the Job Type

definition and have a rate for the primary operator as well as additional

helpers. This method does not take into

account any expenses therefore is useful for simple service jobs where you can

expect to bill so much per hour.

Cost * Markup: This rate calculates the price by

taking your total cost and dividing by your margin %. total cost * (1 + (margin %/100) or for

25% total cost * 1.25 If you have adequate cost data and

correctly calculate your overhead and labor percentages, this is typically the

most accurate costing method.

DSM:JC:M:NOV20